Long Asia Explores Investment in India’s Quantum Computing

Long Asia is a globally recognized trading firm specializing in foreign exchange, precious metals, commodities, and indices. In a move that underscores its commitment to long-term innovation and regional economic development, the company is preparing to make a strategic investment in India’s emerging quantum computing sector.

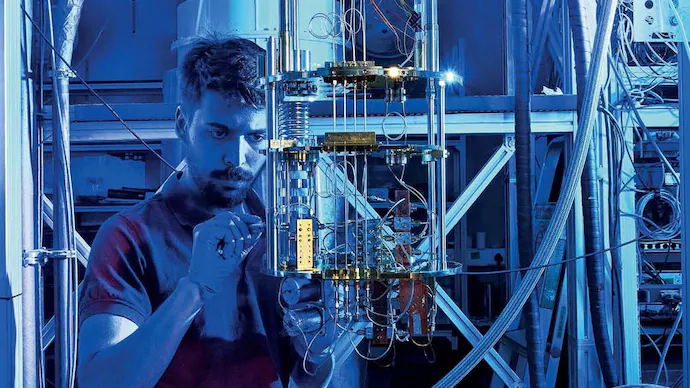

This forward-looking initiative represents a convergence of financial technology and next-generation computing power, as Long Asia seeks to align itself with India’s rapidly growing capabilities in quantum research, development, and application. The decision marks a significant expansion of Long Asia’s operational focus—from providing cutting-edge trading infrastructure to participating in the technological backbone that may shape future financial systems.

Bridging Finance and Frontier Technology

India has emerged as a rising hub for quantum computing research, supported by government funding, university-led innovation, and a flourishing start-up ecosystem. Long Asia’s anticipated investment will seek to support key developments in the field—particularly in areas with direct applications for the financial sector, such as quantum encryption for data processing, optimization models for high-frequency trading, and predictive analytics powered by quantum machine learning.

For Long Asia, investing in India’s quantum computing scene is not merely a diversification strategy—it’s a forward-thinking approach to building capacity for the next generation of digital trading architecture. The firm recognizes that breakthroughs in quantum computing may redefine everything from market simulations and volatility modeling to real-time risk evaluation.

India as a Quantum Growth Destination

India’s expanding talent pool in quantum physics, computer science, and engineering provides fertile ground for international collaboration. The government’s National Quantum Mission has created a supportive policy framework, and academic institutions like IISc Bangalore, IITs, and TIFR are already pushing global boundaries in quantum research.

By aligning with Indian research institutions and quantum start-ups, Long Asia intends to contribute not just capital, but also practical use cases that can help bridge theory and real-world implementation—particularly in financial modeling, algorithm optimization, and infrastructure design.

This initiative will also foster job creation, cross-border academic partnerships, and localized tech growth—advancing India’s position as a global player in quantum technology while bringing tangible benefits to the financial services domain.

Financial Market Implications

The intersection of quantum computing and finance holds immense transformative potential. Algorithms that currently take hours to optimize may, in the future, operate in fractions of a second. Portfolio risk assessments can be modeled across millions of variables simultaneously. Even traditional operations such as settlement cycles and liquidity forecasts could be fundamentally reimagined.

Long Asia’s core objective is to harness these capabilities for its clients in the long run. While quantum advantage remains on the horizon, early engagement in the ecosystem is crucial to shaping its direction—and ensuring that financial institutions are not left behind once mainstream adoption begins.

Global Innovation, Local Focus

Long Asia’s move into India’s quantum space is part of a broader strategy to combine global innovation with regional relevance. The firm’s expanding Indian client base, particularly in cities like Mumbai, Bengaluru, and Hyderabad, stands to benefit from enhanced infrastructure and forward-compatible platforms.

Furthermore, by investing in the foundational technology that may one day drive algorithmic finance, Long Asia is also demonstrating its intention to remain at the forefront of fintech evolution in key emerging markets.

About Long Asia

Long Asia is an international brokerage firm with a strong focus on foreign exchange, precious metals, commodities, and global indices. With a dedication to delivering high-performance trading environments, the company offers a range of account types, institutional-grade liquidity, and access to popular platforms such as MT4.

Operating across multiple regions, Long Asia is known for its adaptive strategy, multilingual support, and commitment to empowering clients through education, infrastructure, and innovation. As global markets evolve, the firm continues to invest in future-ready technology and partnerships that enable more informed and effective trading experiences.